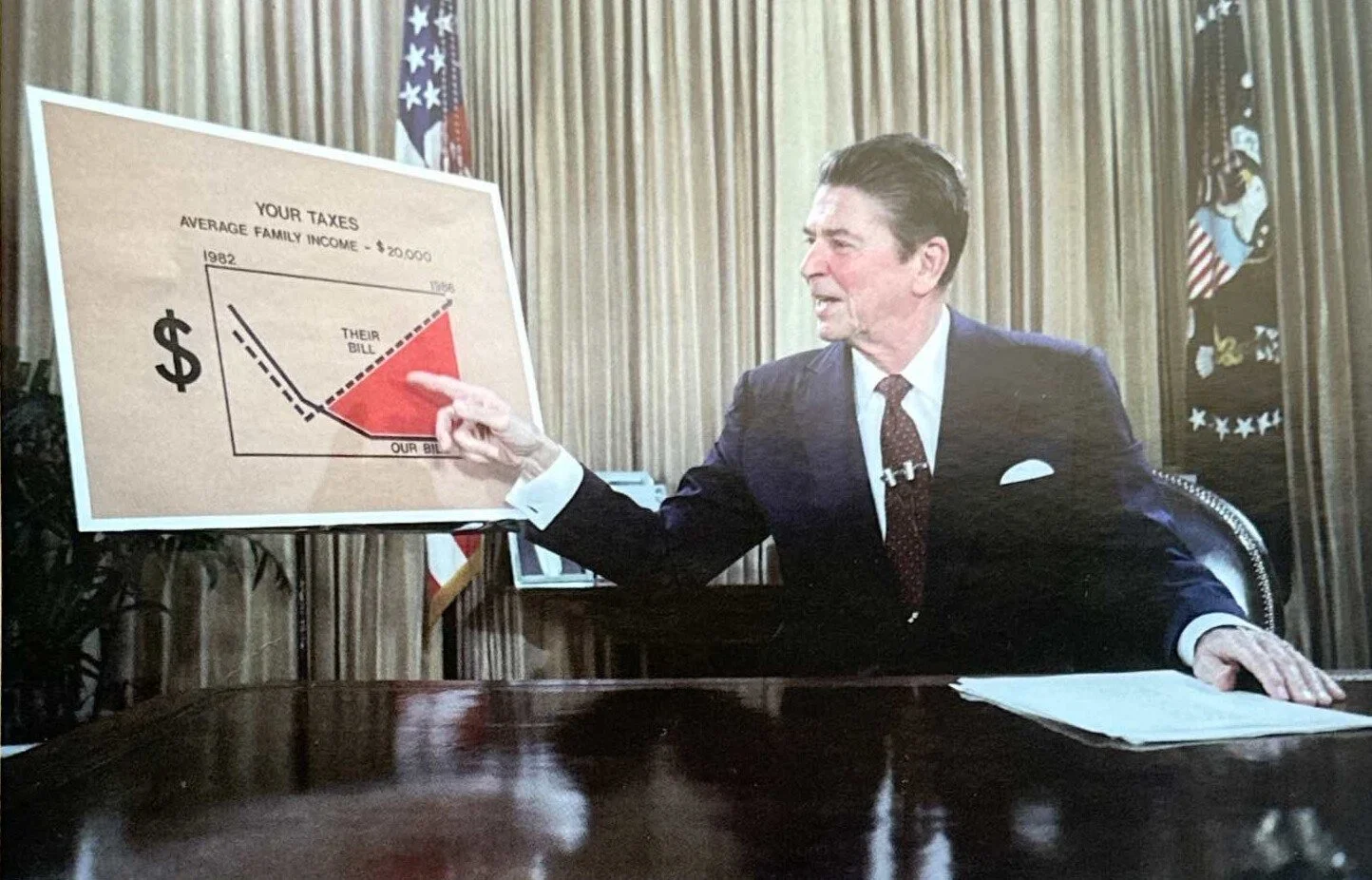

This site explores the historical sources of supply-side economics and the relevance and legacy of this movement in economic thought and policy in the twenty-first century. Supply-side economics refers to the “policy mix” of tax-rate cuts and a dollar stable against gold, specifically as adopted by President Ronald Reagan in the 1980s to address stagflation. “Global monetarism” was the term used to describe the movement in its early years, before journalist Jude Wanniski coined “supply-side economics” in 1977. Economist Marina von Neumann Whitman conceived of “global monetarism” in a now classic article of 1975.

The manager of this site is Brian Domitrovic. Across it are links to Brian’s books, articles, and media appearances on supply-side economics past and present.

For interviews or speaking engagements, contact Brian here.

Brian’s latest book, “Free Money: Bitcoin and the American Monetary Tradition”, is available here

What is “Shrinkflation”?

In his 2009 book Econoclasts: The Rebels Who Sparked the Supply-Side Revolution and Restored American Prosperity, Brian Domitrovic uses shrinkflation to contrast with stagflation (which is persistent inflation combined with stagnant consumer demand and relatively high unemployment). He writes, "Following World War II, the United States traded depression for an acute period of stagflation. Actually, it was 'shrinkflation,' in that the economy was contracting as prices surged." - Excerpted from Merriam-Webster “Words We’re Watching”

Read more about Brian’s coining of the term in this Forbes article.

Free Online Course

Click here for the free online course, “Supply-Side Economics and American Prosperity with Art Laffer” featuring Brian with Dr. Laffer and others via Hillsdale College online courses. Click on the video link to the right to view the trailer.